Allocation Strategies in Your 401k

Your 401k Tutorial Series - Part 2

This is part 2 in a series to explain what you need to know about your Peter Pan Seafoods (PPSF) 401k plan and 401k plans in general. Part 2 applies to all companies’ 401k plans. Here is a link to Part 1.

In part 2 of this series, I want to explain varied methods of allocating your contributions in your 401k plan. These methods are commonly called allocation strategies.

Let’s get started.

Strategic Asset Allocation

The first asset allocation strategy we’ll look at is strategic asset allocation (SAA), sometimes referred to as buy & hold. There are many ways to approach this. My way consists of 4 steps, as follows:

Determine your risk tolerance. You probably have a general idea of your risk tolerance if you are an experienced investor. If you’re new to investing, you may have no idea of how much market volatility you can tolerate. There is no easy way to know how much volatility you can tolerate if you haven’t been through a stock market correction with your money invested. If you’re new and going to guess at your risk tolerance, I think it’s better to err on the conservative side. I’ll try to address this more in a follow on article. For simplicity, I will refer to four levels of risk:

Aggressive - I consider aggressive to be 100% in stock mutual funds at all times. For example, you could direct all of your contributions into the WFSPX fund, which is an S&P 500 index fund.

Moderate - I consider moderate to be 2/3 (about 67%) in stock mutual funds and 1/3 (about 33%) in cash or bond mutual funds. For example, you could direct 2/3 of your contributions into WFSPX and 1/3 into the PTTRX bond fund, which is a PIMCO managed bond fund that acts similarly to a US Aggregate bond fund. Bond funds tend to go up some when stock funds go down, so the bond funds reduce volatility of your account.

Conservative - I consider conservative to be 1/3 in stock mutual funds and 2/3 cash or bond mutual funds. You could direct your contributions into the same two funds with 1/3 into WFSPX and 2/3 into PTTRX. This mix would result in a much lower volatility level.

Ultra Conservative - I consider ultra conservative to be 100% in bond mutual funds or cash equivalents. If you know from experience that you simply cannot tolerate the ups and downs of the stock market, then ultra conservative may be for you. You can still receive the company match and be better off by participating in your company’s 401k plan. Just to be clear, bond funds are not immune to volatility. However, their volatility is normally much less than stock funds.

Select your specific funds. Select the specific funds you want to utilize from your 401k plan’s available options. After deciding on your percentages, you need to select which stock fund(s) and which bond fund(s) or cash equivalent fund(s) you will utilize. I sort of did that in my examples above, but there are several more available funds in PPSF’s 401k plan that you can review and consider.

Implement your strategic asset allocation plan. Complete your 401k plan enrollment forms and turn them into your Payroll or HR office. The enrollment forms have a place to select the exact fund(s) you want and to designate the percentage of your contributions going into each selected fund.

Rebalance. You will need to periodically rebalance your 401k account to match the allocation percentages you decided to go with. There is no exact time interval that is best. I would rebalance once or twice a year. You should decide the interval and date, then stick with that date no matter what. Rebalancing forces you to take some profits from the funds that have appreciated in value the most and buy more of the funds that are down, sometimes known as “buy low and sell high.” Doing this may go against your instincts at the time, but you should rebalance in order to maintain your risk level. Some 401k plans have an option to rebalance automatically for you; something to consider.

Target Date Allocation

Target date allocation is the second asset allocation strategy I want to cover. Target date funds work on the premise that someone who is many years away from retirement will tolerate more risk and associated volatility and that most investors will want to slowly reduce their risk level as they get closer to retirement. With target date funds, you simply select the fund with a year that is closest to when you expect to retire. The mutual fund company will slowly adjust the mix between stocks and bonds through the years to steadily reduce the risk level.

The PPSF 401k plan has T. Rowe Price target date funds dated from 2005 to 2055, with 2005 being the most conservative low risk fund and 2055 the most aggressive higher risk fund.

Tactical Asset Allocation

Tactical asset allocation (TAA), also known as trend following or market timing, is the third asset allocation strategy I want to cover. TAA is a form of quantitative investing using certain data points which will trigger or signal trades from one asset to another. There are literally hundreds or even thousands of data points and methods of analyzing those data points in order to establish trading signals.

Following TAA is normally done with the intent of avoiding large drawdowns and possibly improving investment returns. Another way of summarizing TAA’s goal is to achieve stock market returns with bond-like volatility.

Here is a quick and easy example. We decide at the end of each month if we will hold stocks or bonds. Using the S&P 500 stock index, we hold stocks if the 3 month return of the S&P 500 is equal to or greater than the return of the previously mentioned low risk bond asset fund, PTTRX. We make this decision only once at the end of each month. Any trades that are signaled will be executed at the close of the first trading day of the next month.

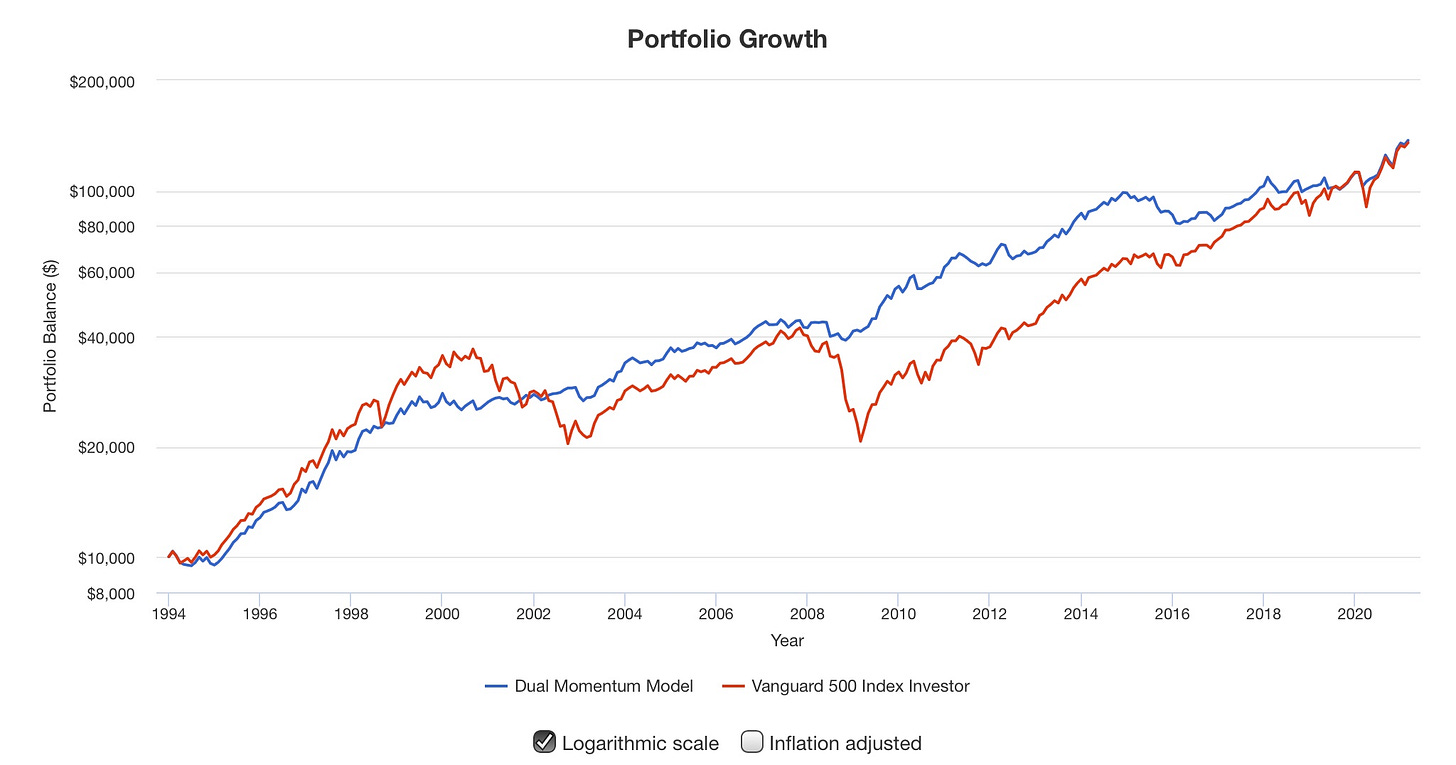

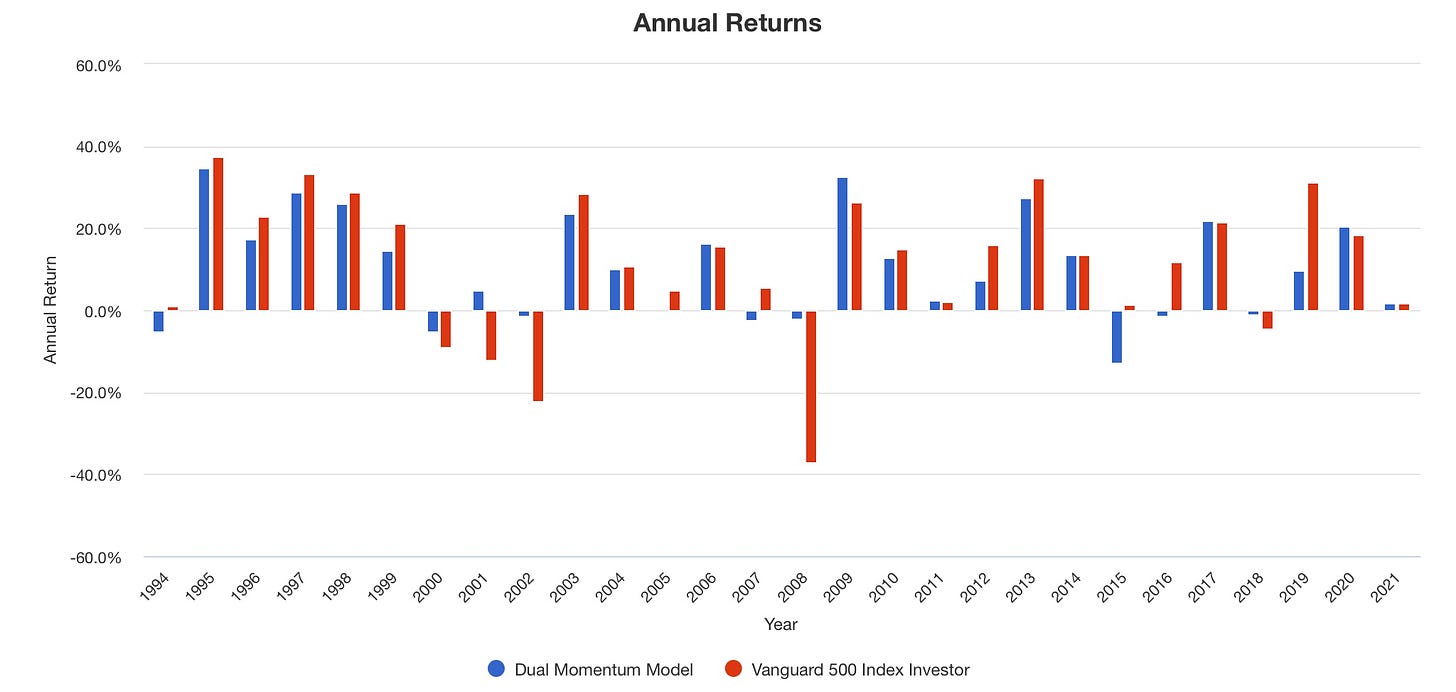

Take a look at the two charts below. The blue line represents our TAA trading system and the red line represents the S&P 500.

You can see from the first chart that the final balance is almost the same for our TAA trading system or simply following the S&P 500 index. However, you can also see the increased volatility of the index compared to the TAA system. The TAA model proves it’s worth during the stock market downturns, but it can lag some during strong up years.

Followers of this TAA model were likely questioning their investment strategy decision by the late 1990s. Those same TAA followers were rewarded for their patience during the severe market downturn of 2000 - 2002. Rather than being left behind, the TAA model was well ahead by 2003. The results were very similar again during the financial crisis of the 2008 - 2009 period.

Summary

I covered three different asset allocation strategies in this article. Each strategy has its advantages and disadvantages. I’ll try to cover these advantages and disadvantages in more depth in future articles.

No single strategy is necessarily better or worse, right or wrong, brilliant or foolish. However, I feel it is very important for investors to give serious consideration to how they will invest their money, develop and document their investment strategy, and stick with it over time.

And by the way, you don’t have to go with just one asset allocation strategy. For example, you could follow one strategy with half of your money and a second strategy with the other half of your money.

Investors can and certainly will change their strategies over time, but those decisions should be well thought out rather than result from a quick market run upwards or downwards. Investors can be and frequently are their own worst enemies when emotions run high due to market gyrations. Don’t let that be you!

Thanks for reading. I hope my brief explanation of asset allocation strategies has helped you understand how you can approach your 401k investment decisions and will help you develop your investment strategy.

Sincerely,

Mike Bishop

Editor, 401k Made Easy